Business Mileage Reimbursement For Electric Vehicles Irse. At mileiq, we frequently get asked, “is mileage reimbursement different for electric vehicles? You’re allowed to pay your employee a certain amount of.

The mileage rates set by hmrc generally provide standard rates for. Former calculations based on the.

Hybrid Cars Are Treated As Either Petrol Or Diesel Cars For Advisory Fuel Rates.

You’re allowed to pay your employee a certain amount of.

The Mileage Rates Set By Hmrc Generally Provide Standard Rates For.

You can generally figure the amount of.

Company Vehicle Tax Expert Harvey Perkins, Director Of Hrux, Looks At How Employers Can Fairly Reimburse Electric Vehicle Drivers For Business Mileage.

Images References :

Vehicle Mileage Log with Reimbursement Form Word & Excel Templates, For example, if a 60kwh charge cost £16.80 and there are 200 miles. Business vehicles (business use only):

Source: lessonschoolklaudia.z13.web.core.windows.net

Source: lessonschoolklaudia.z13.web.core.windows.net

Irs Approved Mileage Log Printable, Hybrid cars are treated as either petrol or diesel cars for advisory fuel rates. As the consumption will be measured accurately by kwh, there will be complete clarity:

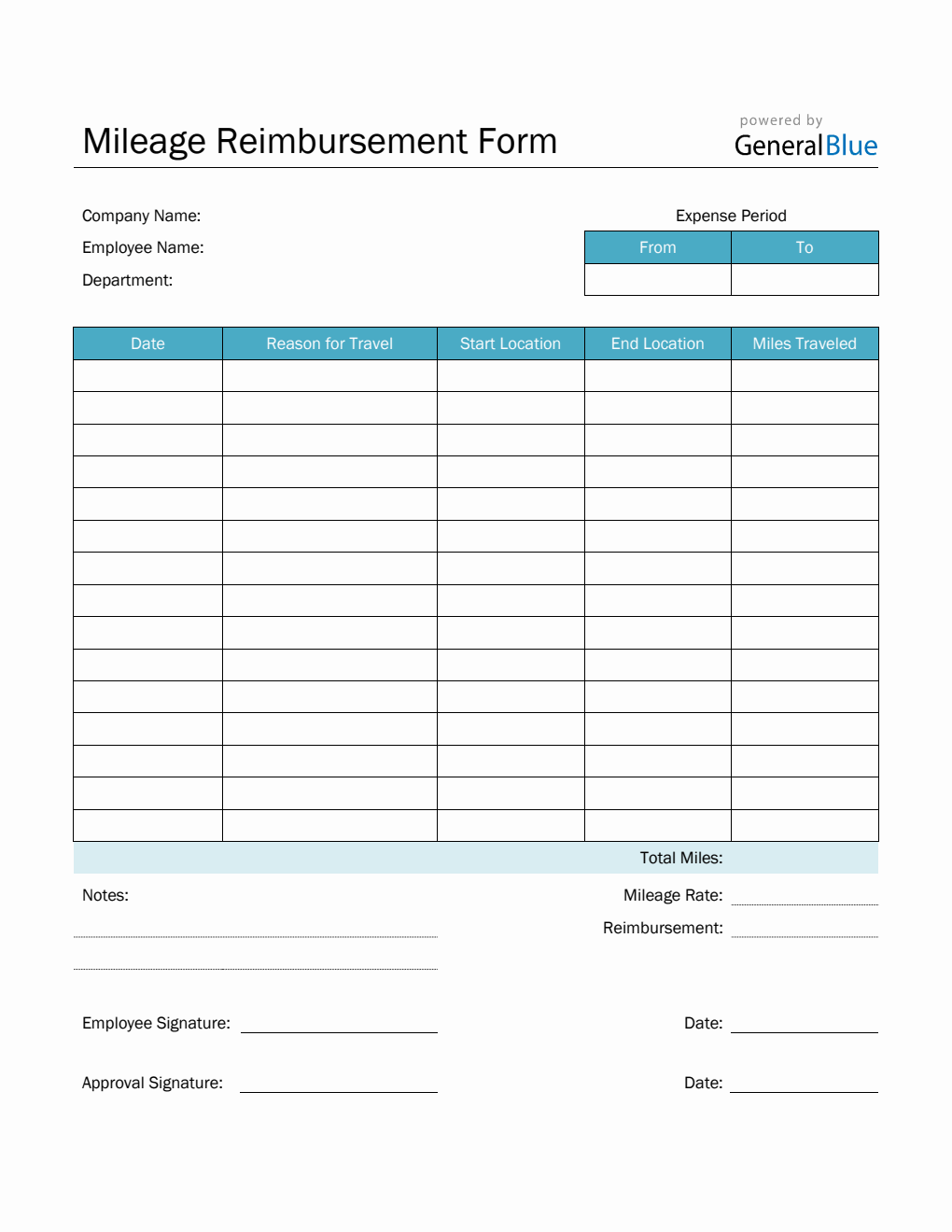

Source: www.generalblue.com

Source: www.generalblue.com

Mileage Reimbursement Form in Word (Basic), That’s where mpge comes in. For example, if a 60kwh charge cost £16.80 and there are 200 miles.

Source: www.travelperk.com

Source: www.travelperk.com

Mileage reimbursement a complete guide TravelPerk, Business vehicles (business use only): The hmrc (the u.k.’s tax authority) has currently set this rate at 45 pence per mile for the first.

Source: www.allbusinesstemplates.com

Source: www.allbusinesstemplates.com

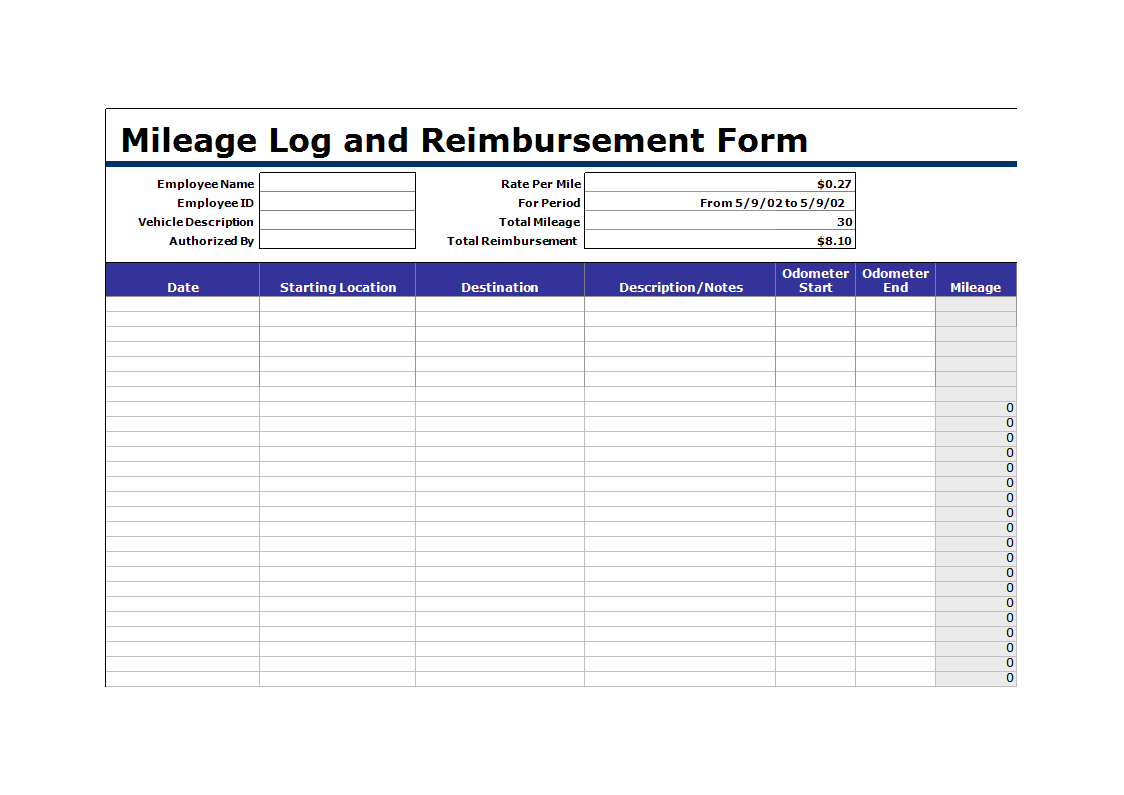

Kostenloses Mileage Log and Reimbursement Form sample, Hybrids are subject to the same mileage rates as equivalent petrol or diesel vehicles. Former calculations based on the.

Source: www.template.net

Source: www.template.net

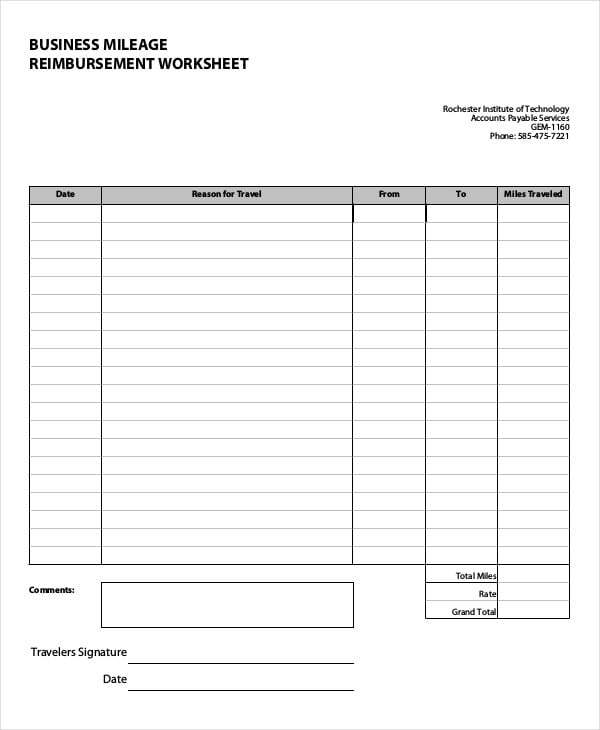

Mileage Reimbursement Form 10+ Free Sample, Example, Format, Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business. Hybrids are subject to the same mileage rates as equivalent petrol or diesel vehicles.

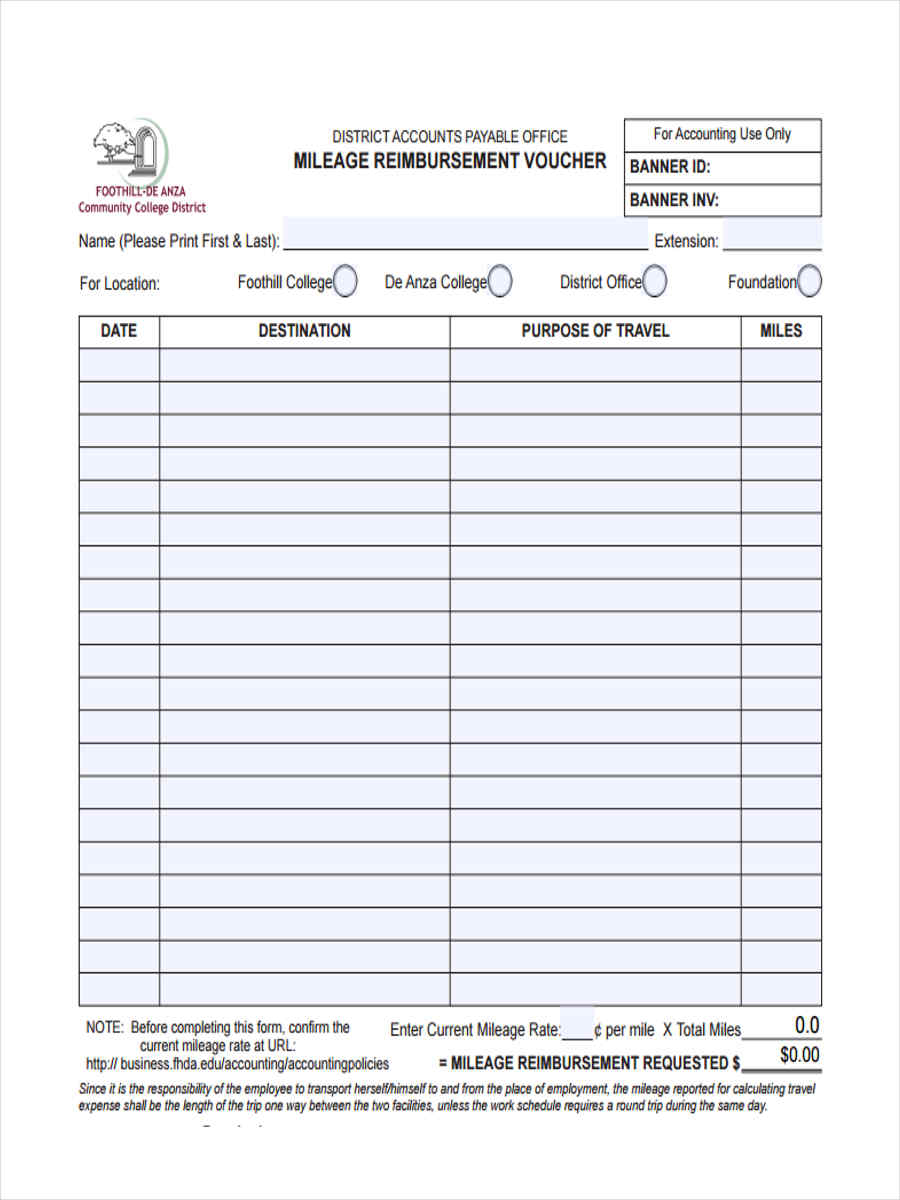

Source: www.sampleforms.com

Source: www.sampleforms.com

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel, Misty erickson of the national association of tax professionals explains what tax pros need to know about the new credits for electric and clean fuel cell. Company vehicle tax expert harvey perkins, director of hrux, looks at how employers can fairly reimburse electric vehicle drivers for business mileage.

Source: leona9425.blogspot.com

Source: leona9425.blogspot.com

Business Mileage Reimbursement Rate 2020 Marie Thoma's Template, Business vehicles (business use only): The mileage rates set by hmrc generally provide standard rates for.

Source: www.elseviersocialsciences.com

Source: www.elseviersocialsciences.com

Mileage Reimbursement Form Pdf FREE DOWNLOAD Elsevier Social Sciences, But reimbursement for business mileage is the tip of the iceberg when it. That’s where mpge comes in.

Source: www.sampleforms.com

Source: www.sampleforms.com

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel, You can use the standard mileage rate for the business use of the pickup trucks, the van, and the cars because you never have more than four vehicles used for business at the. Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business.

The Standard Mileage Rates For 2023 Are:

Hybrid cars are treated as either petrol or diesel cars for advisory fuel rates.

From 1 March 2024, The Advisory Electric Rate For Fully Electric Cars Will Be 9 Pence Per Mile.

Mileage allowance payments ( maps) are what you pay your employee for using their own vehicle for business journeys.